Cost Effective Solutions For Expert Accounting Services.

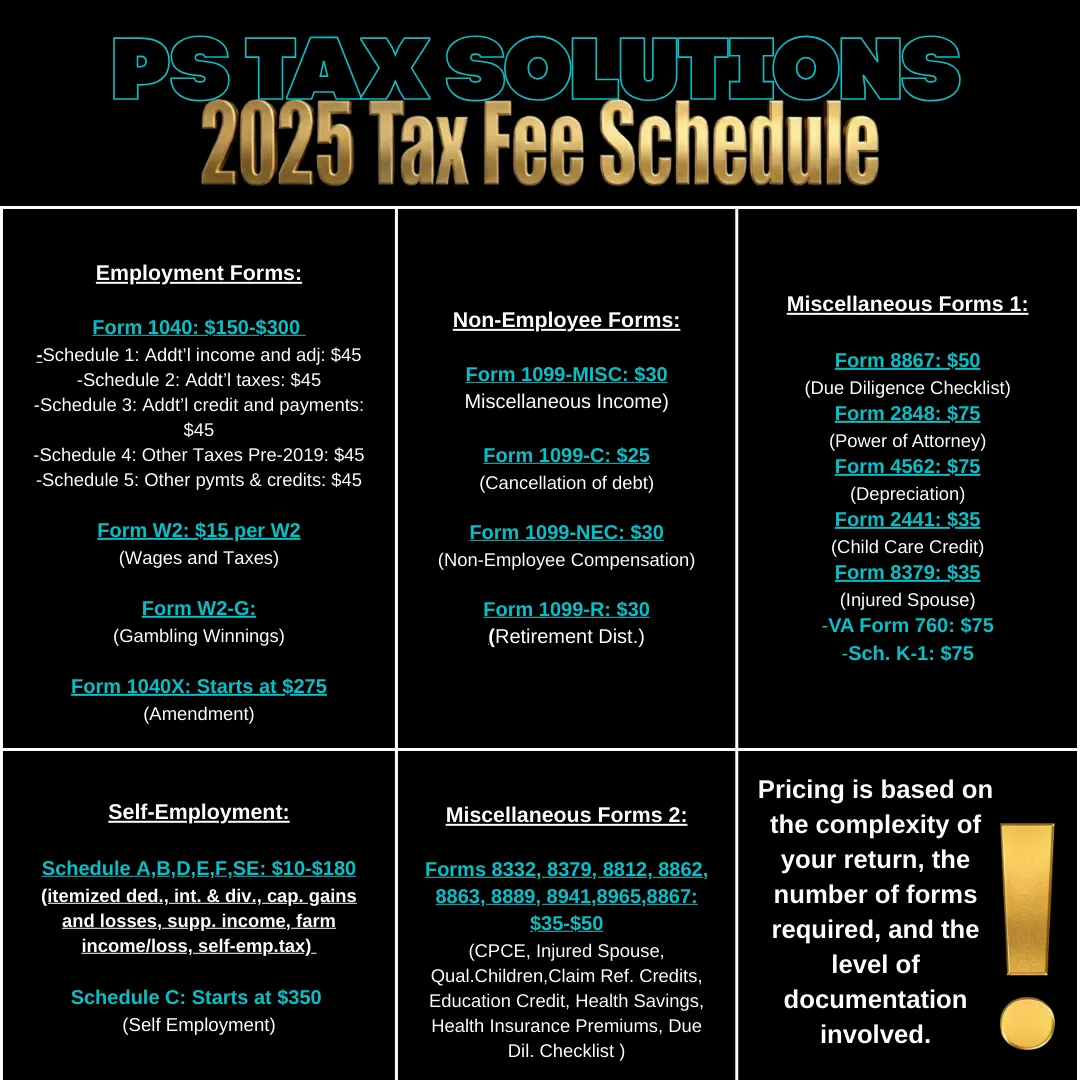

Our tax preparation pricing covers a full range of filing needs, including W-2 income, self-employment/1099 income, and all required due-diligence forms.

Each return is carefully reviewed to ensure accuracy, compliance, and maximum allowable credits and deductions under current tax laws.

Pricing is based on the complexity of your return, the number of forms required, and the level of documentation involved. Our process includes income verification, credit eligibility review, and all mandatory due-diligence requirements to protect both you and our firm.

We focus on real, legal results—no shortcuts, no guesswork, just thorough and responsible tax preparation you can trust.

Frequently Asked Questions

Explore Our Common Queries and Solutions

What documents do I need to file my taxes?

At minimum, you’ll need all income documents such as W-2s, 1099s, or self-employment records. Depending on your situation, you may also need forms like 1095-A (health insurance), child-related documents, or business expense records. Having all documents ready helps avoid delays and amendments.

How long does it take to get my refund?

Once your return is accepted by the IRS, most refunds are issued within 21 days. However, refunds that include certain credits or require additional review may take longer. Processing times can also vary during peak tax season.

Do you help with self employment and 1099 taxes?

Yes. We prepare taxes for self-employed individuals, contractors, and gig workers, including income reporting, expense review, and required schedules. Proper documentation is key to ensuring accurate and compliant filing.

Why does my tax preparation fee vary ?

Tax preparation fees are based on the complexity of your return, the number of forms required, and the level of due diligence involved. Returns with multiple income sources, credits, or business activity require additional time and review to ensure accuracy and compliance.

How can I get in contact with PS Tax Solutions?

We want to ensure that you never walk away with unanswered questions. In the interim of you having questions and may require a quicker response, please contact us via email at [email protected] or 682-688-8892. Allow up to 24 business hours for a response to your inquiry, thank you for your patience in advance.

Contact Us For Financial Solutions Now.

"From Monday to Sunday, our team is here to provide personalized treatment and steady support to help you recover and reach your wellness goals."